Finding a place to rent in Ireland on a low income can feel overwhelming, especially with rising housing costs and high demand across the country. Whether you’re in Dublin, Cork, Limerick or Galway, securing affordable accommodation while earning less than the average wage requires strategy, preparation, and access to the right resources. Thankfully, it’s still possible—with the right approach, persistence, and some digital tools to support your journey, like Tenantin.ie.

Understanding Your Budget and Entitlements

Renting a property in Ireland as a low-income individual begins with understanding your rights and options under Irish tenancy law. The Residential Tenancies Board (RTB) outlines clear protections for renters, ensuring that landlords cannot discriminate against applicants based on income. Still, many landlords prefer tenants with strong profiles and steady financial documentation.

Start by working out your monthly budget. Consider rent, utilities, deposits, and transport. Ideally, rent should not exceed 35% of your net monthly income. If your income is too low to meet that ratio, you may qualify for the Housing Assistance Payment (HAP)—a state subsidy that covers part of your rent, paid directly to the landlord by your local authority.

Why a Strong Tenant Profile Matters

Many renters assume that a high income is the only way to appeal to landlords, but that’s not always true. A clean rental history, positive references, and verified ID documents go a long way.

This is where Tenantin.ie becomes a powerful tool. It allows you to create a digital tenant resume—an organised profile that showcases your references, employment status, income supports like HAP, and your personal introduction. It helps make your application stand out, especially when landlords are sorting through dozens of replies.

For low-income renters, presenting a professional image with verified documents can offset income concerns. Tenantin.ie helps you control the narrative and establish trust—something often missing from rushed, email-based applications.

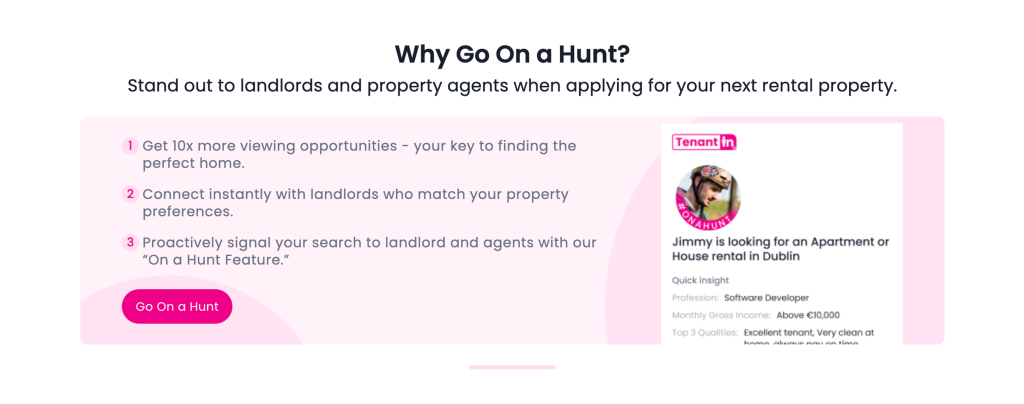

Use “On a Hunt” to Save Time and Improve Your Chances

Tenantin.ie offers a premium feature called “On a Hunt,” which is especially useful if you’re short on time or energy to apply for multiple listings every day. Once activated, this tool automatically sends your profile to suitable landlords on FindQo.ie, matching your rental preferences and budget.

Even better, it includes daily email alerts, so you’re not relying on luck or timing to spot new listings. In a competitive market, speed matters—and Tenantin.ie ensures you don’t miss out on opportunities just because you didn’t check property sites at the right moment.

Strategies for Low-Income Tenants to Succeed

Renting on a tight budget is hard, but not hopeless. Here are a few proven strategies to improve your odds:

- Gather strong references from previous landlords or employers.

- Show financial stability, even if it’s modest (e.g., savings or consistent social welfare payments).

- Be proactive and polite in your communications with landlords.

- Look beyond the big portals: check Facebook groups, local forums, and ask around.

- Consider shared accommodation or homes slightly outside city centres with good transport links.

Always apply with intention. Customise each message to the landlord, explain your situation clearly, and include your Tenantin.ie profile link when appropriate. Demonstrating transparency and preparation is often more persuasive than income figures alone.

Support Services That Can Help

If you’re still struggling to find a home, know that you’re not alone. Organisations like Threshold, Simon Communities, and Citizen Information Centres offer free support to renters. They can help you navigate HAP, appeal unfair treatment, and understand your tenancy rights.

These supports, when combined with a strong rental profile through Tenantin.ie, create a much more solid footing in the rental process—even if you earn below the national average.

Finding Success in a Difficult Market

While renting with low income in Ireland is undeniably challenging, it’s not out of reach. By taking advantage of state supports like HAP, strengthening your rental profile, and using tools like Tenantin.ie, you can significantly increase your chances of securing a safe, affordable place to live.

Staying organised, acting fast, and showing landlords that you’re a reliable tenant—even if your income is modest—can make all the difference.

Frequently Asked Questions

What are my options for affordable housing in Ireland?

In Ireland, affordable housing options for low-income individuals include social housing provided by local authorities and housing associations. Additionally, the Housing Assistance Payment (HAP) can help cover rent costs for eligible tenants. It’s essential to explore these options and understand their requirements.

How can I prove my ability to pay rent on a low income?

Landlords typically require proof of income to ensure tenants can afford the rent. If your income is low, consider providing additional documentation such as a guarantor’s letter, evidence of savings, or proof of receiving HAP or other social benefits. A strong rental history can also be beneficial.

Are there any government schemes that can assist me?

Yes, several government schemes are designed to assist low-income renters. The Housing Assistance Payment (HAP) is a primary scheme where the government pays part of your rent directly to the landlord. You might also qualify for Rent Supplement or apply for local authority housing.

How do I find available properties within my budget?

To find properties within your budget, use online platforms like tenantin.ie, which allow you to filter properties based on price range and location. Regularly check listings and set up alerts to stay informed about new properties that match your criteria.

What should I look for when viewing properties?

When viewing properties, assess the condition of the property, the neighborhood’s safety, proximity to public transport and amenities, and any additional costs such as utilities or maintenance fees. Ensure the property meets your needs and budget before proceeding.

Can I negotiate rent with the landlord if it’s slightly above my budget?

Negotiating rent is possible but depends on various factors such as demand in the area and the landlord’s willingness. Be prepared to explain your situation honestly and highlight your reliability as a tenant. Offering to sign a longer lease might also provide leverage in negotiations.

Is it possible to share accommodation to reduce costs?

Yes, sharing accommodation is a common way to reduce living expenses in Ireland. Consider renting a room in a shared house or apartment, which can significantly lower your monthly costs compared to renting an entire property alone.

How do I apply for social housing?

Applying for social housing involves contacting your local authority to assess your eligibility based on income and need. You’ll need to complete an application form and provide supporting documentation. The process may take time due to high demand, so it’s advisable to apply as early as possible.

What rights do I have as a tenant with low income?

As a tenant in Ireland, you have rights regardless of your income level. These include the right to a rent book or written contract, protection from unfair eviction, and maintenance of safe living conditions by the landlord. Familiarize yourself with these rights through resources like Threshold or Citizens Information.

Where can I get more information on renting with low income in Ireland?

For more detailed guidance on renting with low income, visit tenantin.ie. They offer resources and advice tailored for renters across various income levels, helping you navigate the rental market effectively.

Securing affordable housing on a low income can be challenging but not impossible with the right resources and strategies. By understanding available support systems and knowing how to present yourself as a reliable tenant, you can increase your chances of finding suitable accommodation within your means.