Renting in Ireland can be expensive, especially with demand often outpacing supply in many urban areas. But what if you could reduce your housing costs without giving up comfort, privacy, or quality of life?

Many tenants assume their only options are to downgrade or move further from city centres. However, there are practical ways to save money while still enjoying a comfortable home. In this guide, we’ll show you how to cut housing expenses intelligently, highlight how a strong tenant resume and clean rental history can open up better opportunities, and how Tenantin.ie can support you every step of the way.

1. Create a Strong Tenant Resume to Boost Your Bargaining Power

One of the most overlooked ways to reduce housing costs is by building trust with landlords from the start. That’s where your tenant resume comes in.

A tenant resume is more than a formality. It shows that you’re responsible, reliable, and ready to move in without causing hassle. It typically includes:

- Personal details

- Proof of employment or income

- Previous landlord references

- Rental history

- Credit or affordability information

By presenting a clear, professional profile upfront, landlords may be more open to negotiating rent, especially in private listings where there’s room for flexibility.

With Tenantin.ie, you can build your profile for free. Once your details are entered, you can download your free resume and use it to stand out in a crowded rental market. It’s a small step that can make a big financial difference.

2. Consider a Longer Lease (With the Right Protections)

Some landlords are willing to offer a discounted monthly rate for tenants who commit to a longer-term lease, such as 18 or 24 months. If you’re confident in your location and lifestyle plans, this can lead to significant savings.

However, before agreeing, be sure to:

- Review your lease thoroughly

- Ensure there are fair exit clauses in case of unexpected changes

- Keep your rental history documented in case you need a reference later

Longer leases benefit landlords by reducing vacancy risk, so a well-prepared tenant has the upper hand in these conversations.

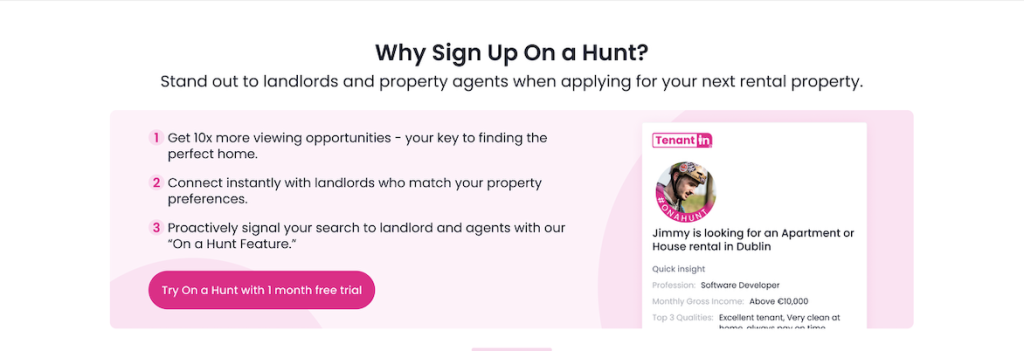

3. Use “On a Hunt” to Get Ahead of the Competition

If you want to find better-value homes before others even know they’re available, the “On a Hunt” premium feature from Tenantin.ie is worth exploring.

Here’s how it can help you cut costs:

- Get daily email alerts with listings from trusted platforms, including niche marketplaces and Facebook groups

- Save time and avoid the stress of constant manual searches

- Automatically send your tenant resume to listings that match your preferences

- Work with an assigned account manager who helps streamline your search and gives expert support

The earlier you see a good listing, the better your chance of locking it in before it’s gone or bid up. That speed, paired with a solid tenant profile, can save you hundreds each month.

4. Share Costs with Trusted Flatmates

While this may seem obvious, many renters overlook the potential for sharing with others in professionally managed house shares or co-living spaces. If done right, this option offers serious cost reductions without sacrificing comfort.

To make shared housing work:

- Vet housemates carefully

- Agree on house rules early

- Choose properties where bills are included to avoid surprises

- Keep your own rental history updated, even in shared homes, to maintain a clean profile

Tenants with strong references and a free resume built on Tenantin.ie often have better chances of being selected in competitive flatshares.

5. Reduce Utility Bills with Smart Upgrades

You don’t need to own a property to reduce your monthly energy bills. Even as a renter, small changes can make a noticeable impact:

- Use energy-efficient bulbs

- Add thermal curtains to reduce heat loss

- Use smart plugs or timers for electronics

- Talk to your landlord about installing insulation or a modern heating system (especially if they qualify for grants)

If you have a good relationship with your landlord and a strong history of responsibility, they’re often willing to invest in upgrades—especially when it improves the value of the property and attracts future tenants.

Pro tip: Use your tenant resume to open the conversation. Showing that you’ve been a model tenant makes it easier to request improvements that benefit both sides.

6. Look Outside the Obvious Areas

Dublin city centre and major towns tend to command the highest rents. However, Ireland’s public transport network is improving, and areas just 20–40 minutes outside the city can offer better value for money without a major lifestyle change.

When exploring other areas:

- Use map tools to calculate commute times

- Look for areas near LUAS, DART, or reliable bus lines

- Set up location-based alerts with your Tenantin account to catch hidden gems

Many users find excellent options in commuter towns, and their costs drop significantly compared to staying centrally. Your comfort doesn’t have to suffer if the location offers green spaces, transport, and local shops.

7. Avoid Bidding Wars with Preparation

One of the fastest ways to overspend is by getting caught in a bidding war, especially for popular rentals. You can avoid this by:

- Having your tenant resume ready to send immediately

- Responding quickly to new listings

- Being flexible with move-in dates

- Offering references and proof of income upfront

This approach shows professionalism and may prompt a landlord to accept your offer without delay. The goal is to be so prepared that no one else gets the chance to outbid you.

8. Take Advantage of Government Supports Where Eligible

Depending on your situation, you may qualify for:

- Rent Supplement

- Housing Assistance Payment (HAP)

- Energy grants that improve home insulation

If you’re unsure whether you’re eligible, speak with your local Citizens Information Centre. These supports can ease your monthly burden, especially in colder months when heating bills spike.

Renting in Ireland Doesn’t Have to Break the Bank

With smart planning, a professional presentation, and proactive tools like Tenantin.ie, renting in Ireland can be affordable and even enjoyable.

Our platform is designed to help you:

- Build your tenant profile for free

- Log your full rental history

- Download and share a professional tenant resume with landlords

- Boost your chances of success through our “On a Hunt” premium option

Thousands of tenants in Ireland are already using our tools to reduce stress and save money. You can too.

Start your free Tenantin.ie profile today

Be ready to act fast, negotiate with confidence, and secure a better rental deal without giving up comfort.

Frequently Asked Questions

What government assistance is available for tenants struggling to pay rent?

In Ireland, tenants may qualify for government assistance such as the Housing Assistance Payment (HAP) or Rent Supplement. These programs are designed to help low-income individuals by contributing towards their rent. It’s important to check your eligibility and apply through your local authority or the Department of Social Protection.

Can I negotiate my rent if I’m having financial difficulties?

While it might not always be possible, tenants can approach their landlords to discuss temporary rent reductions or payment plans if they are experiencing financial hardship. Be prepared to provide evidence of your situation and propose a realistic repayment plan.

Are there any utility bill supports for tenants?

Yes, there are several supports available for managing utility bills. The Household Benefits Package is one such program that offers assistance with electricity and gas bills for eligible individuals. Additionally, the Fuel Allowance is available during the winter months for those who qualify.

How can I manage other household expenses on a tight budget?

Creating and sticking to a budget is crucial when managing household expenses on limited income. Prioritize essential bills like rent and utilities, and cut back on non-essential spending where possible. Numerous online resources and budgeting apps can help you track and manage your expenses effectively.

What should I do if I’m facing eviction due to unpaid rent?

If you’re facing eviction, it’s important to seek advice promptly. Contact organizations like Threshold or FLAC for legal advice and support. They can guide you on your rights as a tenant and help mediate between you and your landlord.

Can local charities or community organizations offer any help?

Many local charities and community organizations offer support for those in financial distress. This support may include food banks, clothing donations, or even financial advice services. Reach out to organizations in your area to learn more about what assistance might be available.

Are there any online platforms that provide information about tenant rights and supports?

Yes, tenantin.ie is an excellent resource for tenants in Ireland seeking information about their rights and available supports. The platform provides up-to-date articles, FAQs, and guidance tailored to the needs of tenants.

Visit tenantin.ie for more information about tenant rights and supports available in your area.

How can I improve my financial literacy to better handle my finances?

Improving financial literacy can empower you to make informed decisions about your money. Consider taking free online courses offered by institutions like Money Advice & Budgeting Service (MABS) which provide insights into budgeting, saving, and managing debt effectively.

Is it possible to get a payment plan for overdue bills?

Some utility companies offer payment plans for customers who are struggling with overdue bills. If you’re behind on payments, contact your service provider as soon as possible to discuss potential arrangements that could prevent disconnection or further penalties.

What should I do if I’m feeling overwhelmed by financial stress?

If financial stress becomes overwhelming, reaching out for support is crucial. Talk to a trusted friend or family member, or consider speaking with a professional counselor who specializes in financial issues. Some support services offer free counseling sessions specifically tailored to financial stress management.

Remember, it’s important to explore all available options and seek help early on if you’re struggling with bills as a tenant in Ireland.