Renting a home in Ireland can be tricky enough—but if you’re self-employed, the process often feels even more complicated. You don’t have a standard payslip, your income might fluctuate, and proving your financial stability can be challenging. That’s why crafting a professional, detailed tenant resume is one of the best tools in your rental arsenal.

At Tenantin.ie, we specialise in helping renters across Ireland build strong profiles, especially those with non-traditional employment. In this guide, we’ll walk you through how to present yourself as a reliable tenant when you’re self-employed, and how your rental history and financial documentation can make all the difference.

Why Renting in Ireland as a Self-Employed Person Is Unique

The Irish rental market is highly competitive. Landlords often receive dozens of applications for a single property. When you’re self-employed, you might be asked for more documentation than a salaried tenant.

Common concerns landlords have about self-employed tenants:

- Irregular income

- Lack of formal payslips

- Difficulty verifying employment

However, with the right documents and a clear, confident tenant CV, you can address these concerns head-on.

What to Include in a Self-Employed Tenant CV

At Tenantin.ie, our free resume tool helps you build a professional profile quickly. Here’s what to focus on when self-employed:

1. Personal Information

Keep it basic but clear:

- Full Name

- Date of Birth

- Contact Info

- ID

This builds the foundation of your tenant profile.

2. Employment Information

Since you’re self-employed, include:

- Your business name or freelance role

- Type of services you provide

- Length of time self-employed

- Average monthly or annual income

- A brief explanation of your work setup (e.g. client base, steady contracts, projects)

Attach or offer supporting documents:

- Recent invoices

- Bank statements (3–6 months)

- Tax returns (preferably last 1–2 years)

- Letter from your accountant (if available)

These help show that you have stable income even if it’s non-traditional.

3. Rental History

A solid rental history proves that you’re responsible and consistent.

Include:

- Previous rental addresses

- Duration at each address

- Contact info for past landlords

- References from those landlords

Good rental behaviour can reassure landlords even more than income.

4. References

In addition to landlord references, consider:

- Client testimonials

- Accountant or solicitor references

These add professional credibility to your profile.

CV Tips to Boost Your Application

Being self-employed doesn’t mean you’re at a disadvantage. These tips will help your tenant CV work harder for you:

Be Transparent

Show your income range and mention if you have savings. Honesty builds trust.

Explain Your Work Clearly

Many landlords may not understand freelancing or creative jobs. Use simple language to describe your business.

Include Proof of Consistency

Even if your income varies month to month, show how you manage your finances. Statements, returns, and contracts are your proof.

Highlight Your Strengths

Are you quiet, punctual, clean, respectful? Mention it. These qualities matter to landlords.

How Tenantin.ie Helps You as a Self-Employed Tenant

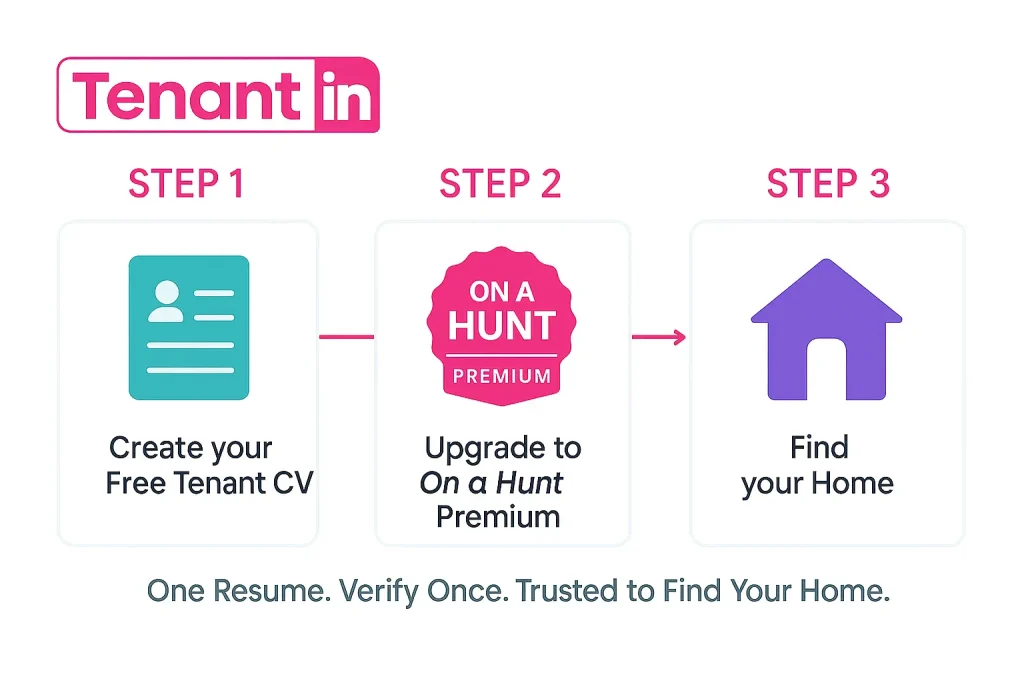

Our free tool makes creating a tenant resume simple and fast. You just:

- Fill in your personal details, employment, and rental history

- Upload supporting documents

- Download and share your resume with private landlords

Your profile stays updated and can be reused for multiple applications, saving you time.

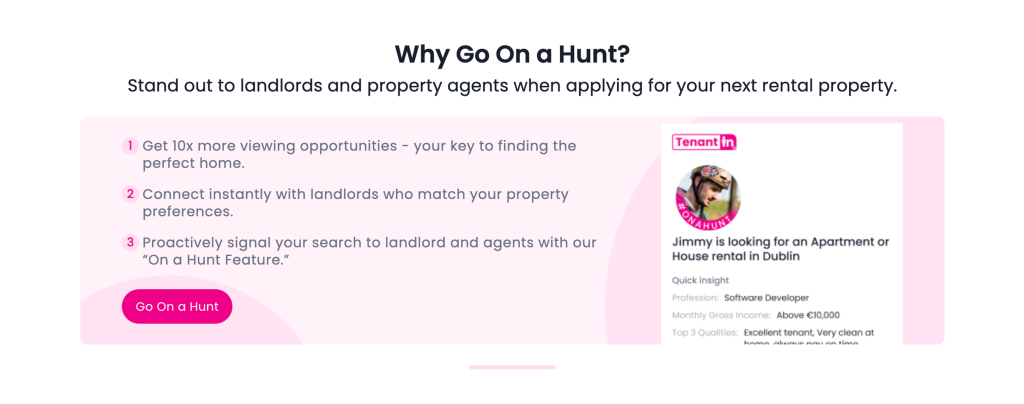

For extra support, our premium service “On a Hunt” offers:

- Daily listing alerts

- Automatic rental enquiries

- Priority CV promotion

- Dedicated account manager

Renting in Ireland while self-employed might come with a few more steps, but it’s completely possible with preparation. A strong tenant CV, proof of income, and solid rental history can help you stand out.

At Tenantin.ie, we’re here to support all kinds of renters—whether you work a 9-to-5 or run your own business.

Frequently Asked Questions

1. How can I prove my income if I’m self-employed?

To demonstrate your income, you can provide your most recent tax returns, bank statements showing regular deposits, or an accountant’s letter verifying your earnings. These documents help landlords understand your financial situation and assure them of your ability to pay rent consistently.

What documents should I prepare when applying for a rental?

In addition to income proof, you’ll typically need identification (such as a passport or driver’s license), references from previous landlords, and possibly a credit report. Preparing these documents in advance can streamline the application process.

How can I improve my chances of renting as a self-employed tenant?

Building a strong rental application is key. Ensure all your documents are up-to-date and well-organized. A detailed cover letter explaining your business and financial stability can also be beneficial. Highlight any long-term contracts or consistent income sources to strengthen your case.

Are there specific areas in Ireland where it’s easier for self-employed tenants to rent?

While there is no specific area that universally favors self-employed tenants, urban centers like Dublin may offer more opportunities due to higher property availability. However, competition can also be stiffer in these areas.

How important are references when renting?

References are crucial as they provide landlords with insights into your reliability as a tenant. A positive reference from a previous landlord or professional contact can significantly enhance your application.

Can platforms like tenantin.ie assist self-employed renters?

Yes, platforms like [tenantin.ie](https://tenantin.ie) provide valuable resources for renters in Ireland, including listings and advice tailored to various tenant needs, including those who are self-employed. They can also help you connect with landlords who have experience with non-traditional income sources.

What should I do if my application is rejected due to being self-employed?

If your application is rejected, ask for feedback to understand the landlord’s concerns. Address these issues in future applications by providing additional documentation or securing a guarantor if needed.

Is it harder to rent as a self-employed person compared to salaried employees?

While it might be perceived as more challenging due to irregular income patterns, being prepared with comprehensive documentation and demonstrating financial stability can alleviate many concerns landlords may have.

Can finding a guarantor help when renting as a self-employed individual?

Yes, having a guarantor can significantly bolster your application by offering landlords additional security. This person agrees to cover rent if you’re unable to pay, which reassures landlords about their risk exposure.

By preparing thoroughly and leveraging available resources like tenantin.ie, self-employed individuals can navigate the Irish rental market more effectively and increase their chances of securing a suitable home.