In Ireland’s competitive rental market, securing a home isn’t as simple as filling out an application. With rising rent prices, strict landlord requirements, and a shortage of available properties, many tenants—particularly students, recent graduates, and newcomers to Ireland—find themselves wondering: Can I use a guarantor on my rental application?

The short answer is yes. But understanding when and how to use a guarantor, and what landlords look for, can make all the difference in your application’s success. In this article, we’ll explore what a guarantor is, how it works in the Irish rental market, and how using a digital rental resume platform like Tenantin.ie can strengthen your application and improve your chances of landing your ideal home.

What Is a Guarantor?

A guarantor is someone who agrees to take legal and financial responsibility for your rent if you are unable to pay. Typically, a guarantor is a parent, relative, or trusted friend with a stable income, clean credit history, and ideally, property ownership in Ireland. They serve as a form of security for landlords—essentially reassuring them that rent will be paid no matter what.

Why Landlords in Ireland Might Ask for a Guarantor

In Ireland, landlords often ask for guarantors when the tenant:

- Has no previous rental history

- Is a student or unemployed

- Is new to Ireland or just started a job

- Has a low income or irregular earnings (e.g., freelancers, self-employed)

- Has poor credit history

A guarantor offers peace of mind for landlords, especially in high-demand cities like Dublin, Cork, or Galway, where housing is limited and applicants are plentiful.

Who Can Be a Guarantor?

Not everyone can be a guarantor. Irish landlords typically prefer someone who:

- Is an Irish resident

- Has a steady income

- Can provide payslips or bank statements

- Has a strong credit rating

- Is willing to sign a legally binding agreement

In some cases, landlords may insist the guarantor is a homeowner in Ireland. This can create challenges for international students or recent arrivals who may not know anyone locally who fits the criteria.

Alternatives If You Don’t Have a Guarantor

If you’re unable to provide a guarantor, don’t panic—there are still options:

- Pay a larger deposit upfront, sometimes two or even three months’ rent

- Provide proof of income or employment contract

- Submit character references from employers, previous landlords, or community leaders

- Create a professional rental resume through platforms like Tenantin.ie, which allows you to showcase your reliability and readiness as a tenant

How Tenantin.ie Can Help You Stand Out—With or Without a Guarantor

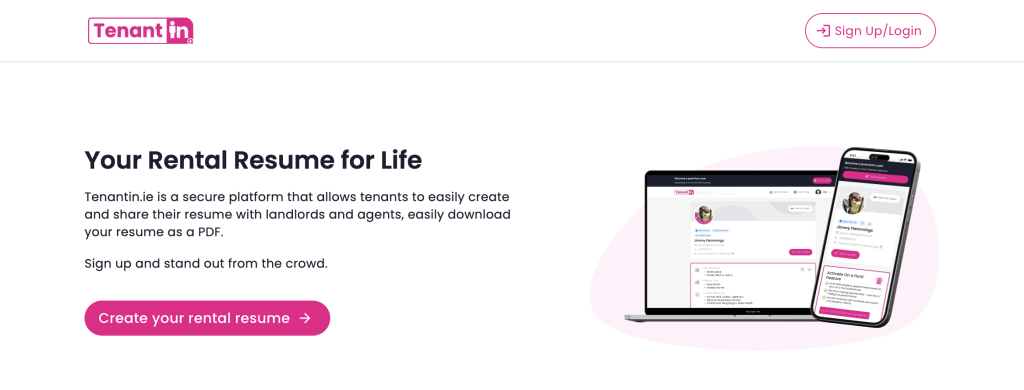

Whether or not you have a guarantor, standing out in Ireland’s rental market is essential. This is where Tenantin.ie comes in. Unlike traditional rental applications, Tenantin.ie allows you to build a comprehensive, professional tenant profile—sometimes referred to as a digital rental CV—which can be shared directly with landlords.

Here’s how it works:

1. Create a Rental Resume

Your profile includes:

- Employment Status

- References

- Identification

- Income Details

- Rental History

- A Personal Bio

This helps establish trust and provides landlords with all the information they need in one place.

2. Activate the “On a Hunt” Feature

If you’re actively searching, Tenantin.ie offers an optional paid feature called “On a Hunt.” When enabled, it automatically connects your rental profile to listings on FindQo.ie, sending your details directly to landlords that match your criteria. It also sends you daily updates with suitable rental listings—making the hunt more proactive and less stressful.

3. Guarantor Support

If you’re using a guarantor, you can include their details within your rental profile, making the process transparent and straightforward for landlords. This boosts credibility and shows you’re prepared and professional.

Will a Guarantor Guarantee You’ll Get the Property?

Unfortunately, no. Even with a guarantor, landlords may still choose another applicant. But a guarantor improves your chances—especially when paired with a well-presented application.

Landlords want:

- Stability

- Proof of Income

- Reliability

- Respectful Tenants

Providing these through your Tenantin.ie profile, backed by a guarantor if needed, ticks all the right boxes.

Important Legal Notes About Guarantors in Ireland

If you’re thinking of using a guarantor, both you and your guarantor should be aware of the legal implications:

- A guarantor is legally bound to cover your rent if you don’t.

- They may also be liable for damage to the property beyond the deposit.

- Their liability can last throughout the entire tenancy, depending on the agreement.

Always read the contract carefully, and if unsure, seek legal advice from a housing rights organization or solicitor.

The Growing Need for Tools Like Tenantin.ie

With demand for rentals at an all-time high and supply remaining tight, Irish renters need every advantage they can get. Landlords are overwhelmed with applications, and they tend to favour tenants who provide clear, complete, and professional profiles. That’s where platforms like Tenantin.ie can make a meaningful difference.

Instead of relying solely on paper documents or email chains, you can now present yourself in a format that mirrors how we apply for jobs—through a polished, trustworthy profile that’s easy to review. It’s efficient for you and reassuring for landlords.

Final Thoughts: Yes, You Can Use a Guarantor—But Be Prepared

To answer the original question: Yes, you can use a guarantor on your rental application in Ireland. In many cases, it’s recommended, especially if you’re new to renting, studying, or lacking steady income.

But a guarantor alone isn’t enough. Presentation matters. Reliability matters. And in a tight market, the best-prepared applicants rise to the top. Using a tool like Tenantin.ie gives you a modern edge, helping you create a rental application that’s clear, complete, and confident—guarantor or not.